JuJu News Hub

Your go-to source for the latest trends and insightful articles.

Get Rewarded for Being You: The Fun of Loyalty Cashback Systems

Discover how loyalty cashback systems turn everyday spending into exciting rewards and savings. Unlock the fun of being rewarded for just being you!

Unlocking the Benefits: How Loyalty Cashback Systems Reward Your Everyday Purchases

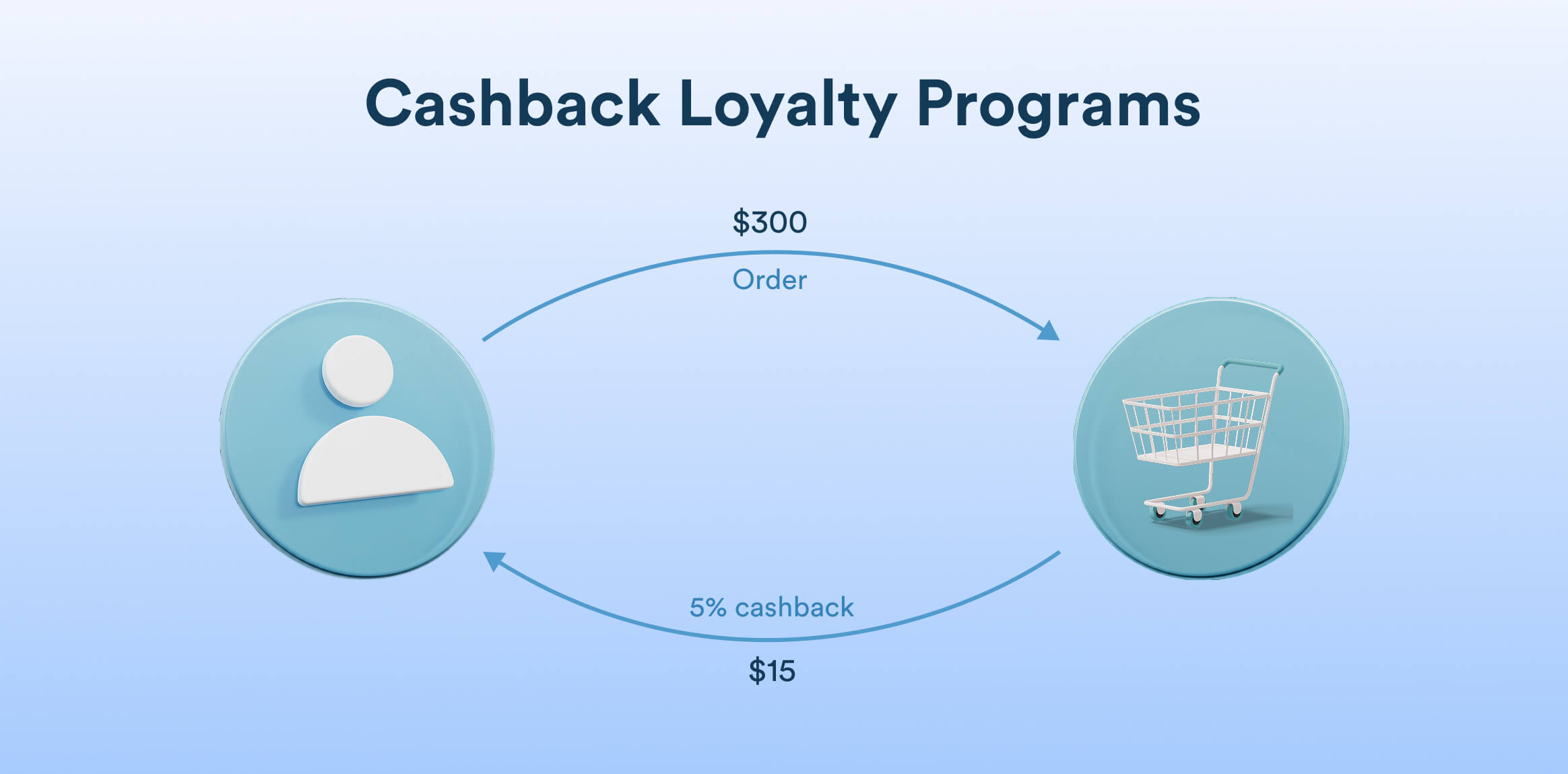

In today's consumer-driven world, loyalty cashback systems have emerged as a powerful tool for maximizing the value of everyday purchases. These programs not only reward customers for their loyalty but also create an enticing opportunity to save money while shopping regularly. By participating in a loyalty cashback system, consumers can earn back a percentage of their spending on qualifying purchases, enhancing their overall shopping experience. Unlocking the benefits of these systems means that even routine tasks like buying groceries or filling up your gas tank can lead to substantial savings over time.

Furthermore, the flexibility of loyalty cashback systems can cater to diverse spending habits, making them accessible for everyone. Rewards can vary widely, with some programs offering cashback on specific categories, while others provide a blanket percentage on all purchases. This versatility allows consumers to choose a program that aligns with their lifestyle and buying patterns. It's important to evaluate different cashback offers and select one that best fits your needs, ensuring that every dollar spent is optimized for maximum rewards.

Counter-Strike is a highly popular tactical first-person shooter that has captivated players around the world. In the game, teams of terrorists and counter-terrorists face off in various objectives, emphasizing strategy and teamwork. Players often look for advantages such as weapon skins and other in-game bonuses, leading many to search for offers like a duel promo code to enhance their gaming experience.

Cashback vs. Points: Which Loyalty Reward System is Right for You?

When deciding between cashback and points for your loyalty reward system, it's important to evaluate your spending habits and preferences. Cashback rewards typically offer a straightforward way to earn a certain percentage back on purchases. For example, many cards provide 1% to 5% cashback depending on the category of the spend. This makes cashback an excellent choice for individuals who prefer immediate and tangible benefits from their purchases. On the other hand, points systems often require more strategic thinking; users earn points for every dollar spent, which can be redeemed for travel, merchandise, or other rewards. If you find yourself traveling frequently or shopping for specific brands, a points-based system might offer greater value.

However, there are several factors to consider before making your choice. Cashback can often be easier to understand, as it provides direct savings that appear on your statement, making it ideal for everyday expenses. In contrast, points systems can come with enticing bonuses, such as bonus points for signing up or special promotions. As you weigh your options, think about your lifestyle. Are you looking for flexibility with your rewards, or do you prefer a simple cash return? Ultimately, the best loyalty reward system for you depends on how you spend your money and what types of rewards will motivate you to engage with the program more regularly.

How to Maximize Your Savings: Tips for Making the Most of Loyalty Cashback Programs

Maximizing your savings through loyalty cashback programs can be a game changer when it comes to managing your finances effectively. These programs reward you for your shopping habits, and with a strategic approach, you can significantly boost your savings. Start by researching and signing up for multiple programs that align with your shopping preferences. For instance, if you frequently shop at a specific grocery store, enroll in their loyalty program to earn cashback on every purchase. Keep an eye on promotional events and bonus days when you can earn increased cashback rates. Combining these opportunities can help you accumulate savings faster.

Another effective tactic is to monitor your spending and make conscious decisions based on cashback offers. Create a list of your regular purchases and categorize them by the cashback rate they offer. Consider switching some of your purchasing habits to higher-reward stores or credit cards that earn more cashback on specific categories such as groceries, gas, or dining out. Additionally, remember to read the fine print of each program to understand any restrictions or expiration dates related to your rewards. By being proactive and informed, you can truly maximize your savings and make the most of loyalty cashback programs.