JuJu News Hub

Your go-to source for the latest trends and insightful articles.

Dancing on the Edge: The Quirky World of Marketplace Liquidity Models

Explore the wild side of marketplace liquidity models! Discover quirky insights and strategies that could redefine your trading game.

Understanding Marketplace Liquidity: Key Models Explained

Understanding marketplace liquidity is essential for anyone involved in trading, investing, or buying and selling goods and services. Liquidity refers to the ease with which an asset can be converted into cash without significantly affecting its price. In the context of marketplaces, liquidity can refer to how quickly and efficiently buyers and sellers can execute their transactions. High liquidity typically results in tighter spreads between the bid and ask prices, while low liquidity can lead to higher volatility and price fluctuations. Various models exist to analyze and enhance liquidity in different types of marketplaces.

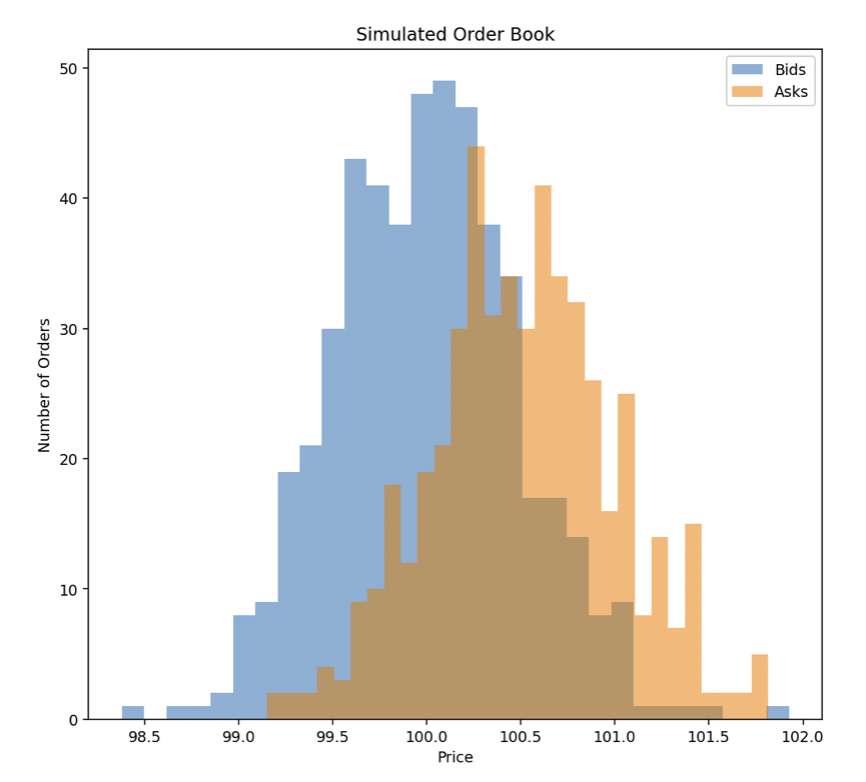

Among the key models to explain marketplace liquidity are the Order Book Model, the Market Maker Model, and the Automated Market Maker (AMM) Model. Order Book Models organize buy and sell orders in real-time, allowing traders to see the available liquidity at any given moment. In contrast, Market Maker Models involve liquidity providers who facilitate trades by offering to buy and sell at specified prices, thus enhancing market efficiency. Lastly, Automated Market Makers use algorithms to set prices and execute trades automatically, creating a decentralized trading environment that can adjust liquidity dynamically.

Counter-Strike is a popular first-person shooter game that emphasizes teamwork and strategy. Players can choose between two opposing teams: Terrorists and Counter-Terrorists. With its competitive gameplay and various game modes, Counter-Strike has become a staple in the esports scene. For players looking to enhance their gaming experience, using a daddyskins promo code can provide access to exciting in-game skins and items.

The Role of Liquidity in Marketplace Success: What You Need to Know

Liquidity plays a crucial role in the success of any marketplace, acting as the lifeblood that facilitates smooth transactions between buyers and sellers. High liquidity means there are enough participants in the market to ensure that assets can be bought and sold easily, which in turn increases the trading volume and contributes to more competitive pricing. When liquidity is abundant, the market can respond swiftly to changes in demand, making it more attractive to participants. Without sufficient liquidity, a marketplace may struggle with price volatility and wider bid-ask spreads, ultimately leading to a decline in user trust and engagement.

For marketplace operators, fostering strong liquidity involves multiple strategies that include attracting a diverse user base, enhancing user experience, and leveraging marketing techniques to increase visibility. Key strategies include:

- Ensuring a wide range of products or services to appeal to more users

- Implementing incentive programs to encourage frequent transactions

- Utilizing data analytics to understand user behavior and preferences

By prioritizing liquidity, marketplace operators can not only enhance their operational efficiency but also improve user satisfaction, which is vital for long-term success.

How Do Different Liquidity Models Impact Buyer and Seller Behavior?

The liquidity models in financial markets play a crucial role in shaping buyer and seller behavior. Different liquidity models can influence how quickly assets can be bought or sold without causing significant price changes. For instance, in a market characterized by high liquidity, buyers and sellers can execute trades with minimal price impact, promoting more frequent transactions and encouraging active participation. Conversely, in a low liquidity environment, even small trades can lead to substantial price fluctuations, which may deter potential buyers and sellers from entering the market due to increased risk.

Understanding the impact of various liquidity models is essential for market participants. For example, in a dealer market, traders often rely on market makers to provide liquidity, which can lead to more stable prices and greater buyer confidence. On the other hand, in an order-driven market, where trades are matched directly without intermediaries, buyer and seller behavior is largely influenced by the depth of the order book. This can create opportunities for informed traders to capitalize on price discrepancies, highlighting the intricacies of how liquidity influences trading behaviors.