JuJu News Hub

Your go-to source for the latest trends and insightful articles.

Why Paying More for Less Insurance is So Last Season

Discover why overpaying for inadequate insurance is outdated. Unlock smarter, affordable coverage options today!

The Truth About Insurance: Why More Premiums Don't Mean Better Coverage

The notion that higher insurance premiums equate to superior coverage is a common misconception. In reality, the relationship between premium costs and coverage quality is often misleading. Factors such as your geographical location, the type of coverage you select, and even your claims history can significantly impact your premium costs without necessarily enhancing your coverage. Understanding the details of your policy is crucial; for example, many policies may appear comprehensive due to high premiums, yet include numerous exclusions that leave you vulnerable in specific situations. Therefore, it is essential to dissect your policy and ensure it aligns with your actual needs rather than relying solely on the cost as an indicator of value.

Moreover, insurance companies may charge higher premiums due to their overall business strategies rather than the quality of coverage. For instance, a firm with extensive marketing campaigns or a luxurious reputation might price their policies higher, but that does not inherently improve the protection they offer. Instead, it’s vital to compare different providers and scrutinize their offerings, focusing on crucial factors such as deductibles, limits, and exclusions. Only by taking a thorough approach to understand both your needs and the nuances of your insurance options will you be able to find a policy that provides the coverage you require without unnecessary financial strain.

Cutting Costs: How to Find Quality Insurance Without Breaking the Bank

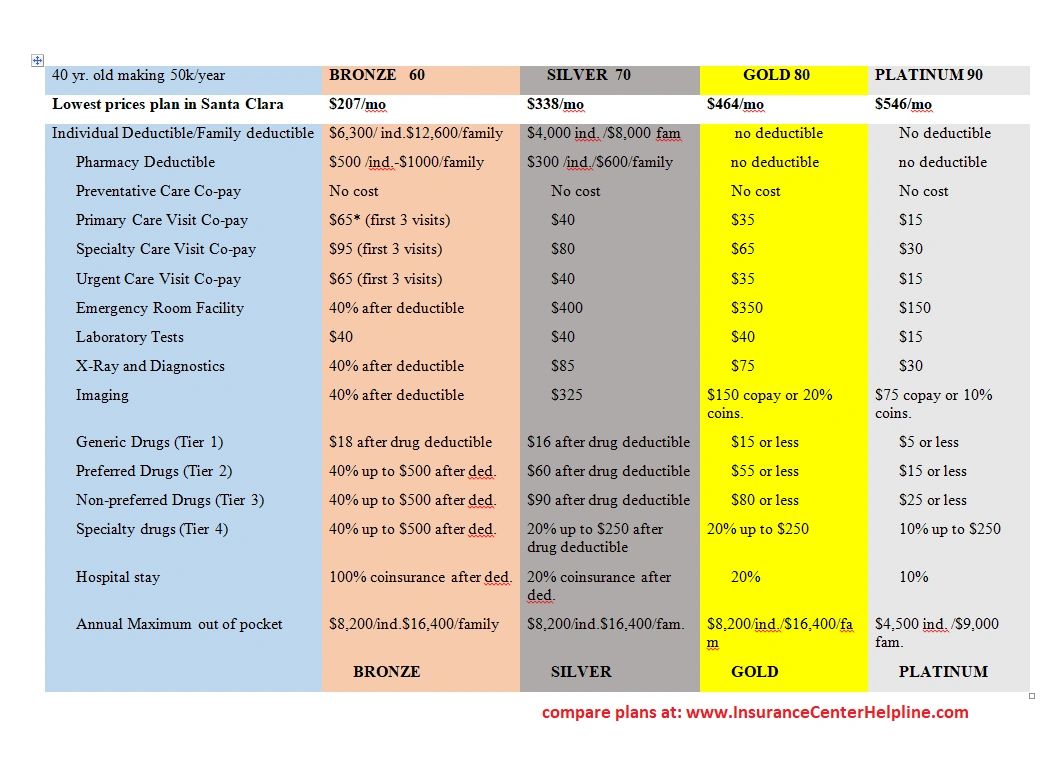

In today's financially dynamic environment, cutting costs on essential expenditures has become increasingly vital. When it comes to finding quality insurance that doesn't drain your wallet, it all starts with doing thorough research. Begin by comparing quotes from multiple providers to identify the best rates. Utilize online comparison tools and take advantage of customer reviews to gauge the reliability and coverage options of each insurer. Furthermore, consider bundling your insurance policies—such as home and auto—to unlock discounts that many companies offer. By being proactive and informed, you can navigate the vast landscape of options available without sacrificing quality.

Another key strategy in finding quality insurance without breaking the bank is to assess your actual coverage needs. Many policyholders are unaware that they may be over-insured or paying for additional features they don't require. For instance, reevaluate your policy limits and deductibles; increasing your deductible might lower your premium significantly. Additionally, look for potential discounts that providers often offer, such as safe driver discounts or affiliations with certain organizations. Remember that the goal is to find a balance between affordability and adequate coverage to ensure you're financially protected without overspending.

Is Your Insurance Working Harder Than You Are? Discover the New Standards

In today's fast-paced world, insurance is more than just a safety net; it's a critical asset that needs to perform optimally. Many individuals and businesses overlook whether their policies are genuinely working harder than they are. The evolving landscape of risks—from natural disasters to cyber threats—requires a reassessment of your insurance coverages. Discover the new standards that ensure your insurance adapts to current challenges and provides comprehensive protection tailored to your unique needs.

To evaluate if your insurance is truly working harder than you, consider the following criteria:

- Coverage adequacy: Is your policy up-to-date with today’s risks?

- Cost-effectiveness: Are you getting the best value for your premiums?

- Claims process efficiency: How quickly and easily can you access support when needed?