JuJu News Hub

Your go-to source for the latest trends and insightful articles.

Cheap Insurance: More Savings, Fewer Headaches

Discover how cheap insurance can lead to more savings and fewer headaches. Unlock the secrets to affordable coverage today!

10 Tips for Finding Cheap Insurance Without Sacrificing Coverage

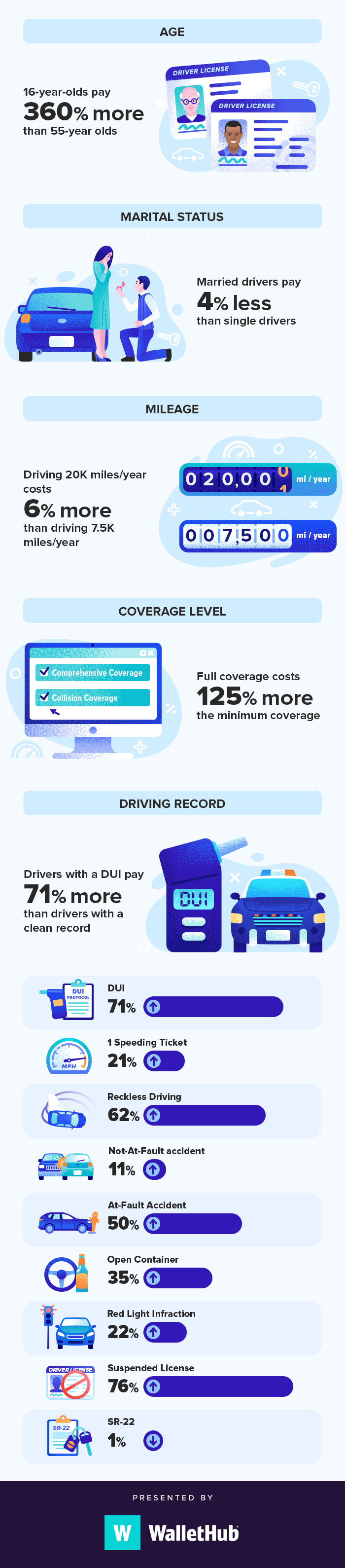

Finding cheap insurance without compromising on coverage can be a daunting task, but with the right strategies, it's entirely possible. Start by comparing quotes from multiple providers using online tools or by contacting agents directly. This allows you to evaluate different policies and their costs side by side. Additionally, consider adjusting your deductibles; a higher deductible can lower your premium, but make sure you can afford the out-of-pocket expense in case of a claim.

Another effective tip is to look for discounts that insurers offer. Many companies provide savings for bundling policies, maintaining a good driving record, or even for being a member of specific organizations. Don't hesitate to ask about any special programs that could lower your costs. Lastly, review your coverage regularly; as your circumstances change, you might find that certain coverage options are no longer necessary, allowing you to trim your policy to fit your budget while still maintaining essential protection.

How to Compare Insurance Quotes for Maximum Savings

Comparing insurance quotes is a crucial step in ensuring you get the best deal for your coverage needs. Start by gathering quotes from multiple insurance providers, as rates can vary significantly. Make a list of the policies you are interested in and break down the quotes based on key factors such as coverage limits, deductibles, and premiums. This organized approach allows you to easily see the differences in costs and coverage options, making it easier to identify potential maximum savings.

Once you have your quotes organized, it’s essential to understand the fine print. Look for hidden fees, exclusions, and any discounts that may apply, such as multi-policy or safe driver discounts. Consider using online calculators to compare the overall value of each policy, rather than just the price. Additionally, talking directly to an agent can provide insight into which coverage options might be unnecessary based on your lifestyle, helping you to further enhance your savings.

Is Cheap Insurance Worth the Risk? What You Need to Know

When it comes to purchasing insurance, the allure of cheap insurance can be tempting. However, it’s essential to consider whether the savings are worth the potential risks involved. While cheaper premiums might save you money in the short term, they often come with significant trade-offs, such as limited coverage, higher deductibles, or a lack of essential features. Before opting for a budget policy, it's crucial to evaluate your specific needs and the overall financial implications. Ask yourself: What am I sacrificing for lower rates?

Moreover, cheap insurance may result in inadequate protection when you need it most. If you experience a major claim, insufficient coverage could lead to higher out-of-pocket expenses that outweigh your initial savings. To make an informed decision, consider the following key points about affordable insurance:

- Read the fine print: Understand the limitations and exclusions of the policy.

- Compare coverage: Ensure you’re comparing similar levels of coverage across different providers.

- Assess customer reviews: Research the insurer’s reputation for handling claims.

Ultimately, evaluating these factors can help you determine if cheap insurance is genuinely worth the risk.