JuJu News Hub

Your go-to source for the latest trends and insightful articles.

Why Renters Insurance is Your Best Roommate Ever

Discover why renters insurance is the ultimate roommate—protecting your belongings and saving you money in a pinch! Don't miss out!

Understanding the Benefits of Renters Insurance: Your Ultimate Safety Net

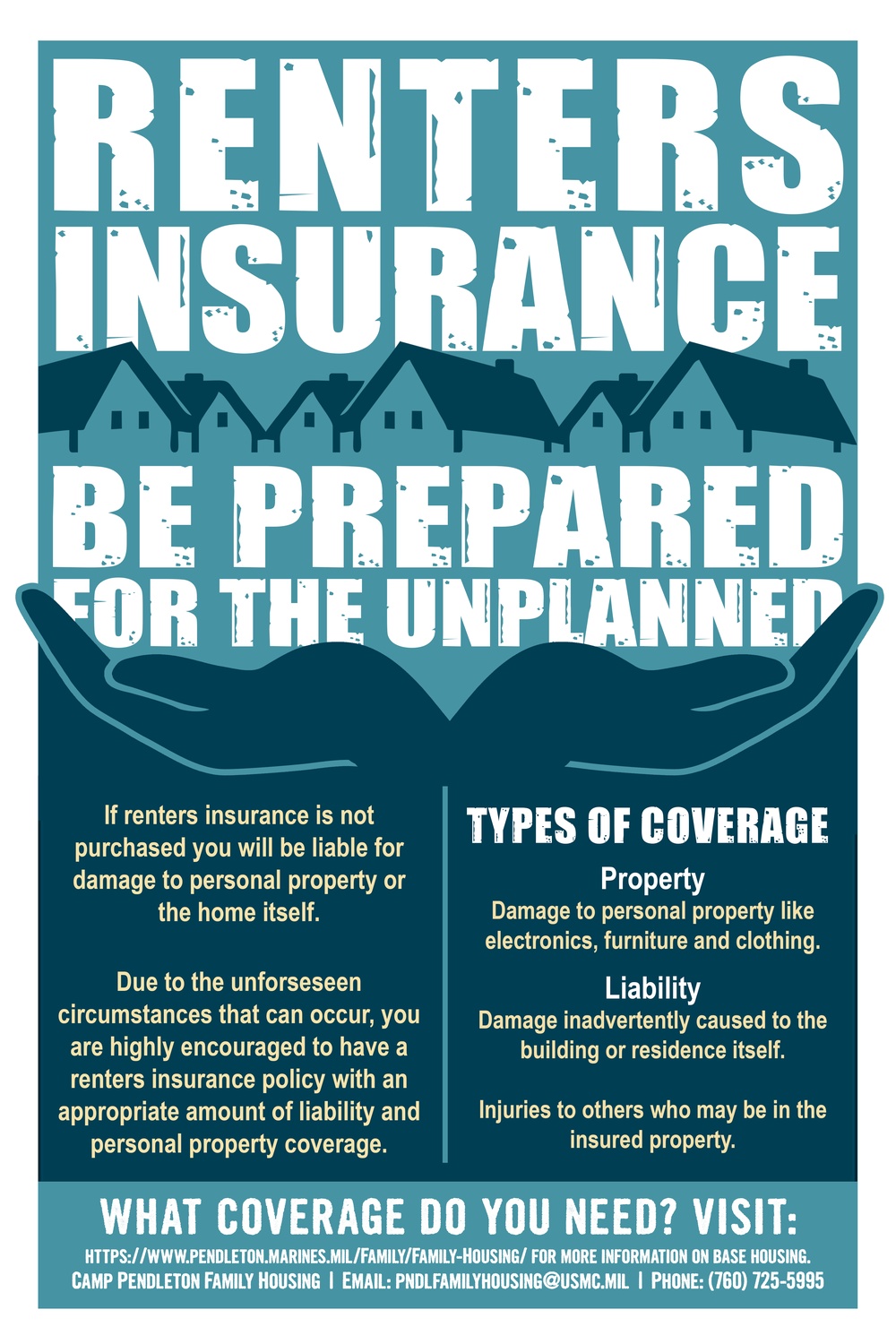

Understanding the benefits of renters insurance is crucial for anyone living in a rental property. Renters insurance provides vital financial protection for your personal belongings against unforeseen events such as theft, fire, or water damage. This type of insurance typically covers not only personal property but also liability issues that may arise if someone gets injured in your rental space. Without adequate coverage, tenants risk losing their valuable possessions and facing significant out-of-pocket expenses, making renters insurance an essential part of safeguarding your assets.

Moreover, renters insurance is often more affordable than people assume. Policies can range widely in price, but most tenants can find coverage available for less than a cup of coffee each day. Additionally, many insurance providers offer discounts for bundling renters insurance with other types of coverage, such as auto insurance. By investing in renters insurance, you not only protect your belongings but also gain peace of mind knowing that you have a safety net in place should unexpected situations arise.

Is Renters Insurance Worth It? 5 Reasons It’s Your Best Roommate

When considering whether renters insurance is worth it, there are several compelling reasons to think of it as your best roommate. Firstly, it provides financial protection for your personal belongings in case of theft, fire, or water damage. According to industry statistics, more than 50% of renters underestimate the total value of their possessions, which can lead to costly surprises in the event of a disaster. By investing in renters insurance, you're essentially safeguarding your assets and ensuring that you can quickly recover without incurring significant out-of-pocket expenses.

Secondly, having renters insurance can provide you with liability coverage, protecting you in case someone gets injured in your rented home. If a guest slips and falls or suffers an injury, you could potentially be held liable for their medical expenses. With renters insurance, you not only cover the potential financial burden but also gain peace of mind knowing that you are protected from unexpected legal claims. In short, renters insurance isn’t just a safety net; it’s an essential component of responsible renting that every tenant should consider.

How Renters Insurance Protects You: Common Questions Answered

When it comes to protecting your personal belongings, renters insurance is an essential investment for anyone who occupies a rental property. It typically covers losses due to theft, fire, vandalism, and certain natural disasters, ensuring you’re not left financially vulnerable in the event of an unexpected mishap. Many renters may wonder, 'What does my policy actually cover?' It's crucial to understand that while renters insurance provides liability coverage, helping protect you if someone is injured in your home, it also safeguards your possessions against common risks, giving you peace of mind as a tenant.

An often-asked question is, 'How much does renters insurance cost?' The average premium can vary widely based on factors such as the value of your belongings and the coverage limits you choose. Generally, renters insurance is quite affordable; many policies range from $10 to $30 a month, making it a cost-effective way to protect your finances. Additionally, those wondering about how to file a claim may find the process straightforward, requiring basic documentation like photos of damaged items and a police report for theft, streamlining your recovery efforts when disaster strikes.